vprosto.ru News

News

Auto Loan Rates Based On Credit Score

Car loans are usually in month increments, with common terms being 24, 36, 48, 60, 72 or 84 months. NerdWallet recommends trying to go no more than 60 months. FICO® credit scores are the auto industry standard for determining a potential buyer's creditworthiness. Using a variety of factors, the company will give you a. One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means. Auto Loan Interest Rates for + Model Year Vehicles. Apply. Term, Annual rate based on borrower credit score, loan amount, vehicle age and condition. Finding and funding your vehicle is easy. Secure a low-rate auto loan in Kansas Rates based on credit score and applicable discounts. 2 New auto loans only. IT PAYS TO HAVE A GOOD SCORE: ; $20,, 60 months, +, %, $ ; $20,, 60 months, , %, $ Example: A buyer with a FICO score may qualify for $ at 96 months, but a score may be maxed out at $ for 72 months. Move the time and money. Time to buy a car? myAutoloan can save you time and cash. Apply once and get as many as four loan offers in minutes. It's simple and secure! For borrowers with credit scores of and above, the average interest rate for a new car loan has been %. The Bottom Line. Choosing a car loan is always a. Car loans are usually in month increments, with common terms being 24, 36, 48, 60, 72 or 84 months. NerdWallet recommends trying to go no more than 60 months. FICO® credit scores are the auto industry standard for determining a potential buyer's creditworthiness. Using a variety of factors, the company will give you a. One of the main factors lenders consider when you apply for a loan is your credit score. A higher score can help you secure a better interest rate—which means. Auto Loan Interest Rates for + Model Year Vehicles. Apply. Term, Annual rate based on borrower credit score, loan amount, vehicle age and condition. Finding and funding your vehicle is easy. Secure a low-rate auto loan in Kansas Rates based on credit score and applicable discounts. 2 New auto loans only. IT PAYS TO HAVE A GOOD SCORE: ; $20,, 60 months, +, %, $ ; $20,, 60 months, , %, $ Example: A buyer with a FICO score may qualify for $ at 96 months, but a score may be maxed out at $ for 72 months. Move the time and money. Time to buy a car? myAutoloan can save you time and cash. Apply once and get as many as four loan offers in minutes. It's simple and secure! For borrowers with credit scores of and above, the average interest rate for a new car loan has been %. The Bottom Line. Choosing a car loan is always a.

Actual payment varies based on credit score, loan amount, term, model year, and type of vehicle. U) For the College Auto Loan, borrower must be at least New Vehicle ; Primary borrower credit score, +, , , ; Max Term, APR. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. Those with great credit may be able to get a car loan rate between 3% and 4% while those with bad credit or no credit could end up paying an annual percentage. Average interest rates for car loans ; , , , ; New-car loan, %, %, %, %. Auto Loan Interest Rate Factors · Credit Score - The higher your FICO credit score, the lower the interest rate you can expect to receive on your auto loan. Minimum credit score of required to qualify for promotion. Vehicle must be a or newer. Existing 1st Advantage loans are not eligible for refinance. Not. Rates and APRs were based on a self-identified credit score of or higher Still, like many other car loan lenders, NFCU doesn't disclose its minimum credit. , %, $ ; APR = Annual Percentage Rate. Rates subject to change at any time. Up to % financing available for vehicle years Your. Interest rates for car loans can vary greatly based on your credit score and the lender. As of now, a good interest rate for a new car loan. Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of. If your credit score is below , you may face a higher interest rate than if your score was or higher. This could be a difference of thousands of dollars. Possible % rate discount is available, depending on your credit score, for loans with a loan-to-value ratio under 80%. Total maximum rate discount is %. credit union or bank financing), and most importantly, the buyer's credit score. When it comes to car loan interest rates based on credit score, having a higher. New/Used Auto financing available up to % Loan to Value ; %, %, %, % ; %, %, %, %. Fixed auto loan interest rates as low as % APR¹ with MyStyle® Checking discount · No application fees · Terms up to six years² · Onsite financing—tell the. ** The APR (Annual Percentage Rate) is based on credit worthiness A lower credit score may cause a higher loan rate. Used Car Loans. Term*. Rate. Auto Loan Rates: Loan annual percentage rates (APR) based on member credit qualification and total loan amount. What credit score do I need to get an auto. Average Auto Loan Rates by Credit Score ; Deep subprime, , %, % ; Subprime, , %, %. The best interest rate for you will depend on your credit and the type of car you purchase. With rates starting as low as % APR, we are committed to.

How Many Numbers Are In Ein

An Employer Identification Number (EIN) is a nine-digit ID assigned by the Internal Revenue Service (IRS). One of five Tax ID Numbers (TINs), it's used to. TINs and EINs are not the same thing, but they're often mixed up with one another. Some of the reasons so many people wonder “is a TIN number the same as EIN”. Daily limitation of an employer identification number ; Kansas City. 40, 44 ; Memphis. 94, 95 ; Ogden. 80, 90 ; Philadelphia. 33, 39, 41, 42, 43, 46, 48, 62, 63, Yes. Much like a Social Security number, the government uses your EIN (also known as a federal business tax ID number) to identify your business. Even though it's called an Employer Identification Number, an EIN is not just for companies that have employees. An EIN is used for many business tasks. An EIN, or “Employer Identification Number”, is an identification number assigned by the IRS to your business. An employer identification number is a unique nine-digit number that is assigned to a business entity. EINs allow the IRS to easily identify businesses for tax. What is an EIN and how do I get one? An employer identification number is the nine-digit number the IRS requires from business owners who pay employees. But. A federal tax ID number is a unique, nine-digit number that is issued by the IRS to identify a business for tax reporting purposes. An Employer Identification Number (EIN) is a nine-digit ID assigned by the Internal Revenue Service (IRS). One of five Tax ID Numbers (TINs), it's used to. TINs and EINs are not the same thing, but they're often mixed up with one another. Some of the reasons so many people wonder “is a TIN number the same as EIN”. Daily limitation of an employer identification number ; Kansas City. 40, 44 ; Memphis. 94, 95 ; Ogden. 80, 90 ; Philadelphia. 33, 39, 41, 42, 43, 46, 48, 62, 63, Yes. Much like a Social Security number, the government uses your EIN (also known as a federal business tax ID number) to identify your business. Even though it's called an Employer Identification Number, an EIN is not just for companies that have employees. An EIN is used for many business tasks. An EIN, or “Employer Identification Number”, is an identification number assigned by the IRS to your business. An employer identification number is a unique nine-digit number that is assigned to a business entity. EINs allow the IRS to easily identify businesses for tax. What is an EIN and how do I get one? An employer identification number is the nine-digit number the IRS requires from business owners who pay employees. But. A federal tax ID number is a unique, nine-digit number that is issued by the IRS to identify a business for tax reporting purposes.

An Employer Identification Number (EIN) is a tax ID for business entities such as LLCs and corporations. 3. The similarity between these two numbers is that. How Much Does it Cost to Get an EIN? Obtaining an Employer Identification Number (EIN) from the IRS is free of charge. You can apply for an EIN online, by fax. Think of your EIN, or Tax Identification Number, as your business's social security number. For the most part, you don't need to know the specifics about your. Whether or not you are a business owner with employees, the identification number is referred to as an Employer Identification Number, or EIN for short. Table. A Federal Tax Identification Number, also known as a "95 Number", "E.I.N. Number," or "Tax I.D. Number", all refer to the nine digit number issued by the IRS. An employer identification number (EIN) is a unique number that the IRS associates with your business. Learn how to apply for one and how to look up an EIN. How much does Northwest's EIN service cost? · If you have an SSN: $ In this case, it's a piece of cake for you. We charge $50 to get you an EIN from the IRS. An Employer Identification Number (EIN) is also known as a federal tax identification number, and is used to identify a business entity. It is also used by. There are many numbers that are used to identify ourselves and our corporations or LLCs, such as a Social Security number, driver's license number. EINs are also called Federal Tax Identification Numbers or Federal Employer Identification Numbers. Many types of organizations have EINs, including. How Many Numbers Is An EIN? EIN numbers are nine digits and have the following format: two digits, a dash, followed by seven more digits (e.g., ). An Employer Identification Number (EIN) is a unique nine-digit number issued by the Internal Revenue Service (IRS) in the United States. Businesses need an Employer Identification Number (EIN) for many common purposes. EINs are issued by the Internal Revenue Service. A: Yes. An Employer Identification Number (EIN) is an organization's federal identification number, much like an individual's Social Security Number. An. Another acronym for the federal tax ID number is the EIN, which stands for Employer Identification Number. An EIN must come from the IRS in order to be a. A federal tax ID number is a unique 9-digit number that's assigned to a business or organization by the Internal Revenue Service (IRS). It identifies your. There is no fee for applying for an EIN. Related Resources. Texas Business Resources; Employer Identification Number (EIN). Much like a Social Security Number, an Employer Identification Number (EIN) is a federal nine-digit number that identifies a business entity. If your business is a single entity with different divisions it does not require each division to have its own EIN, one EIN can be used. How to Get a Tax ID Number The SS4 is the IRS form required to obtain an EIN (Employer Identification Number, frequently called a Tax ID number). The EIN/Tax.

Shldq Stocks

Sears Holdings Corporation Stock Forecast. Open Broker Account. $ +0 (+0%). At Close: Jan 30, Real-time prices appear during market hours. Sears Holdings (OTCMKT: SHLDQ) stock has since been relegated to the OTCMKT or “pink sheets” market and now trades under $ per share. Get the latest Sears Holdings Corp (SHLDQ) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Delisting typically occurs when a stock no longer meets exchange requirements. Other reasons for delisting may include legal violations, bankruptcy, a decrease. Stocks. Ticker. Ticker. SHLDQ. Ticker. Company. Current Price. Market Cap. Volume. Ticker. Company. Current Price. Market Cap. Volume. SHLDQ, Sears Holdings. Sears Holdings Stock Forecast, SHLDQ stock price prediction. Price target in 14 days: USD. The best long-term & short-term Sears Holdings share price. View Sears Holdings Corporation SHLDQ investment & stock information. Get the latest Sears Holdings Corporation SHLDQ detailed stock quotes, stock data. Sears Holdings (SHLDQ) last ex-dividend date was on ―. Sears Holdings distributed ― per share that represents a ― dividend yield. Sears Holdings (SHLDQ) advanced chart and technical analysis tool allows you to add studies and indicators such as Moving Averages (SMA and EMA), MACD. Sears Holdings Corporation Stock Forecast. Open Broker Account. $ +0 (+0%). At Close: Jan 30, Real-time prices appear during market hours. Sears Holdings (OTCMKT: SHLDQ) stock has since been relegated to the OTCMKT or “pink sheets” market and now trades under $ per share. Get the latest Sears Holdings Corp (SHLDQ) stock price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Delisting typically occurs when a stock no longer meets exchange requirements. Other reasons for delisting may include legal violations, bankruptcy, a decrease. Stocks. Ticker. Ticker. SHLDQ. Ticker. Company. Current Price. Market Cap. Volume. Ticker. Company. Current Price. Market Cap. Volume. SHLDQ, Sears Holdings. Sears Holdings Stock Forecast, SHLDQ stock price prediction. Price target in 14 days: USD. The best long-term & short-term Sears Holdings share price. View Sears Holdings Corporation SHLDQ investment & stock information. Get the latest Sears Holdings Corporation SHLDQ detailed stock quotes, stock data. Sears Holdings (SHLDQ) last ex-dividend date was on ―. Sears Holdings distributed ― per share that represents a ― dividend yield. Sears Holdings (SHLDQ) advanced chart and technical analysis tool allows you to add studies and indicators such as Moving Averages (SMA and EMA), MACD.

Sears Holdings Corporation (SHLDQ.): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock Sears Holdings Corporation | OTC. Stock Price and Dividend Data for Sears Holdings Corp (SHLDQ), including dividend dates, dividend yield, company news, and key financial metrics. SHLDQOTC Markets • delayed by 15 minutes • USD. Sears Holdings Corp (SHLDQ). at close. (%). Summary Financials Analysis Earnings Investors. Take the stock certificate and frame it. Use it as a reminder of the huge mistake you made in either purchasing the stock of Sears or. SHLDQ is defunct since August 10, Summary. Sears Holdings Corporation (CE) SHLDQ streaming chart, price, news, and trades. View SEARS HOLDINGS CORP (SHLDQ) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. SHLDQ's dividend yield, history, payout ratio & much more! vprosto.ru: The #1 Source For Dividend Investing. SHLDQ SEARS HOLDINGS CORP. 15min Delay Close Nov 1 ET. Investments in stocks, options, ETFs and other instruments are subject. The current price of SHLDQ is USD — it has decreased by −% in the past 24 hours. Watch SEARS HOLDINGS CORP stock price performance more closely on. SHLDQ - Sears Holdings Corp Stock - Stock Price, Institutional Ownership, Shareholders (OTC). Webull offers Sears Holdings (SHLDQ) historical stock prices, in-depth market analysis, EXMKT: SHLDQ real-time stock quote data, in-depth charts. The latest Sears Holdings stock prices, stock quotes, news, and SHLDQ history to help you invest and trade smarter. Free SEARS HOLDINGS CORP (SHLDQ) analysis tools, including analyst ratings and target price forecasts, help you make informed investment decisions. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. If you buy shares of SHLDQ you are investing in: The NOLs and tax credits valued at $ Billion. Potential Lawsuit Proceeds in SHLDQ/UCC v ESL. Provide free SEARS HOLDINGS CORP (SHLDQ) major events announcements, including the company's latest resolutions of the general meeting of shareholders. SHLDQ - Sears Holdings Corp Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (OTC). r/SHLDQ1: A place for theoretical discussions about business and stocks - specifically SEARS Stock ($SHLDQ). Opinions and memes welcome. None of this.

Loan To Capital Ratio

This ratio determines a company's level of indebtedness, in other words, the proportion of its assets that is owned by its creditors. It complements the capital adequacy ratios compiled based on the methodology agreed to by the Basle Committee on Banking Supervision. Also, it measures. The total debt to capitalization ratio is a solvency measure that shows the proportion of debt a company uses to finance its assets, relative to the amount of. Capital-to-assets ratio, %, %, %, %. Capital and allowance for credit losses on loans as a % of loans, %, %, %, %. Debt. a total capital ratio of 9%. Registered banks must have a prudential capital buffer (PCB), completely made up of Common Equity Tier 1 (CET1) capital, over and. The debt-to-equity ratio is a simple formula to show how capital has been raised to run a business. It's considered an important financial metric. The debt-to-capital ratio evaluates how much debt a company has compared to its overall capital. The debt-to-equity ratio (D/E) is a financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets. A leverage ratio is any kind of financial ratio that indicates the level of debt incurred by a business entity against several other accounts. This ratio determines a company's level of indebtedness, in other words, the proportion of its assets that is owned by its creditors. It complements the capital adequacy ratios compiled based on the methodology agreed to by the Basle Committee on Banking Supervision. Also, it measures. The total debt to capitalization ratio is a solvency measure that shows the proportion of debt a company uses to finance its assets, relative to the amount of. Capital-to-assets ratio, %, %, %, %. Capital and allowance for credit losses on loans as a % of loans, %, %, %, %. Debt. a total capital ratio of 9%. Registered banks must have a prudential capital buffer (PCB), completely made up of Common Equity Tier 1 (CET1) capital, over and. The debt-to-equity ratio is a simple formula to show how capital has been raised to run a business. It's considered an important financial metric. The debt-to-capital ratio evaluates how much debt a company has compared to its overall capital. The debt-to-equity ratio (D/E) is a financial ratio indicating the relative proportion of shareholders' equity and debt used to finance a company's assets. A leverage ratio is any kind of financial ratio that indicates the level of debt incurred by a business entity against several other accounts.

For low-income designated credit unions only, Net Worth also includes. Subordinated Debt and Grandfathered Secondary Capital in accordance with the Net Worth. The debt-to-equity ratio is a simple formula to show how capital has been raised to run a business. It's considered an important financial metric. This FSI is a capital adequacy ratio and is an important indicator of the capacity of bank capital to withstand losses from NPLs. I4. Nonperforming loans to. More specifically, for banks, a capital adequacy ratio is calculated as the amount of capital relative to its 'risk-weighted assets'. Risk-weighted assets, in. A company's debt-to-capital ratio or D/C ratio is the ratio of its total debt to its total capital, its debt and equity combined. The ratio measures a company's. The debt service coverage ratio (DSCR) is a number that measures a property's current rental income compared to its debt obligations. A DSCR above indicates. Debt capital is money that is borrowed and must eventually be repaid—usually with interest. It's a type of short-term financing, which can be useful for. The instruments covered include all fixed-rate and floating-rate debt securities and and liabilities that is completely matched, its capital/asset ratio will. Principal and Interest to Income Ratio: The ratio, expressed as a percentage, which results when a borrower's proposed Principal and Interest payment expenses. Working capital ratio is a measure of business liquidity, calculated simply by dividing your business's total current assets by its total current liabilities. Debt-to-Capital Ratio = Total Debt / (Total Debt + Total Equity); Debt-to This is usually a type of “cash flow loan” and is generally only available to larger. What is a good debt-to-equity ratio? Although it varies from industry to industry, a debt-to-equity ratio of around 2 or is generally considered good. This. The Debt to Equity Ratio is a leverage ratio that calculates the value of total debt and financial liabilities against the total shareholder's equity. Working capital ratio is a measure of business liquidity, calculated simply by dividing your business's total current assets by its total current liabilities. Working capital ratio is a measurement that shows a business's current assets as a proportion of its liabilities. It's a metric that provides an overview of. Past due payments;. •. Prepayment rates;. •. Property types;. •. Average loan-to-value ratios; This reduction may result in a relatively higher capital-to-. (A) The loan-to-value ratio is less than or equal to the applicable maximum A Board-regulated institution's common equity tier 1 capital ratio is the ratio. a loan's loan-to-value (LTV) ratio and depending on whether the loan is dependent on the cash flows generated by the real estate Proposed risk weights for. a minimum CET1 capital ratio requirement of percent, which is the same for each bank; · the stress capital buffer (SCB) requirement, which is determined from. Working capital ratio is a measurement that shows a business's current assets as a proportion of its liabilities. It's a metric that provides an overview of.

What Is The Best Free Crypto Wallet

They are generally free so they are a good option for users that are just starting out with crypto or only want to hold a small amount of crypto. Some even use. Exodus is a strong leader in this list as a cross-platform cryptocurrency wallet. Exodus wallet is used by people new to crypto (digital currency). Exodus. The best software wallets · Coinbase Wallet · MetaMask · Guarda · vprosto.ru DeFi Wallet · Trust Wallet · Exodus · ZenGo. Lykke offers an all-in-one free crypto trading platform with zero trading fees and low buy-sell spreads. We cover your fiat deposit and withdrawal fees. Coinbase Wallet: The best crypto wallet for beginners that is available on both desktop and mobile. eToro: One of the easiest cryptocurrency wallets to use with. OK. We use cookies to ensure you get the best experience on our website. Please read our. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs, DeFi activity, and digital assets. Coinbase Wallet · Windows, Android, iOS, Mac · Hot Wallet · Incorporated exchange · Hardware wallet compatible · Cloud storage · Cold storage · Free · Coinbase Inc. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs. They are generally free so they are a good option for users that are just starting out with crypto or only want to hold a small amount of crypto. Some even use. Exodus is a strong leader in this list as a cross-platform cryptocurrency wallet. Exodus wallet is used by people new to crypto (digital currency). Exodus. The best software wallets · Coinbase Wallet · MetaMask · Guarda · vprosto.ru DeFi Wallet · Trust Wallet · Exodus · ZenGo. Lykke offers an all-in-one free crypto trading platform with zero trading fees and low buy-sell spreads. We cover your fiat deposit and withdrawal fees. Coinbase Wallet: The best crypto wallet for beginners that is available on both desktop and mobile. eToro: One of the easiest cryptocurrency wallets to use with. OK. We use cookies to ensure you get the best experience on our website. Please read our. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs, DeFi activity, and digital assets. Coinbase Wallet · Windows, Android, iOS, Mac · Hot Wallet · Incorporated exchange · Hardware wallet compatible · Cloud storage · Cold storage · Free · Coinbase Inc. Coinbase Wallet is your key to what's next in crypto. Coinbase Wallet is a secure web3 wallet and browser that puts you in control of your crypto, NFTs.

Guarda Wallet is a highly secure and user-friendly cryptocurrency wallet that allows users to buy, store, swap, and earn a wide range of crypto assets. Finally, while Coinbase Wallet is free to use, be mindful of network transaction fees associated with cryptocurrency transfers. Coinbase's involvement with. Since launch, more than three million people have chosen Phantom (that's us!) as their dedicated wallet, making it one of the most proven and popular wallets in. Select the hardware you want to use. There are various crypto wallet options available. Some of the top names in this space include Ledger, Trezor, and Keepkey. NC Wallet is the first wallet that allows you to withdraw cryptocurrency without paying network fees. #. No withdrawal minimum. There are no transaction limits. Buy, stake, swap, and manage cryptocurrencies with the best Cryptocurrency Wallet & Bitcoin Wallet. Secure Atomic Wallet for your crypto assets and NFTs. OK. We use cookies to ensure you get the best experience on our website. Please read our. The most popular and easy-to-set-up crypto wallet is a hosted wallet. When you buy crypto using an app like Coinbase, your crypto is automatically held in a. Bitcoin PaperWallet. This is a free anonymous crypto wallet; it is merely a piece of paper with a private and public key. It also allows you to destroy cache. A cold wallet or hardware wallet is definitely the safest type of cryptocurrency wallet for storing Bitcoin or your public and private keys. A hardware wallet. Crypto wallets provide users with a reliable and typically non-custodial application in which they can store and manage all of their cryptocurrencies. Electrum is user-friendly, has a simple interface, and allows you to control your private keys. These features make it a top choice for many. The Freewallet Family includes dedicated wallets for + popular cryptocurrencies available on Android and iOS, as well as a Multi-currency wallet app with a. Bitcoin PaperWallet. This is a free anonymous crypto wallet; it is merely a piece of paper with a private and public key. It also allows you to destroy cache. Top 10 Best Crypto Wallet Apps in the Crypto Industry · Coinbase Wallet · Trust Wallet · Zengo MPC Wallet · Exodus Wallet · Qredo Wallet · MetaMask. Best Free Cryptocurrency Wallets Software · Zengo · Trust Wallet · Plaid · OKX Wallet · ECOS · Radom · Trezor Wallet · CoinDCX · (6) · View Profile. The aptly named Best Wallet tops the list largely due to its ease of use. This ambitious project features a well-designed anonymous crypto wallet with. Exodus Bitcoin & Crypto Wallet. The only wallet you'll ever need. 50+ networks supported. Swap between s of assets. Best bitcoin and crypto wallets · Coinbase Wallet Web3: Best bitcoin hot wallet. · Ledger: Best bitcoin cold wallet. · SafePal: Best crypto hot wallet. · Ledger. Most free crypto sign-up bonuses require opening an account with a crypto exchange or online stock broker and making a certain deposit.

Starting My Cleaning Business

The process is: · Apply for an ABN (free & you can do it online) · Register a business name (unless you are going to trade under your own name). The cost is. BUSINESS QUICK START GUIDE. FOR JANITORIAL BUSINESSES. Janitorial service is a type of commercial cleaning that tackles different tasks in professional office. Starting a house cleaning business has never been easier! Discover the essential steps you need to take to launch and grow your cleaning business. How To: Start Your Own Cleaning Company · Step One: Do your research · Step Two: Plan your business · Step Three: Register your business · Step Four: Get the. Starting a commercial cleaning business can require some time and investment, but this type of business is typically within reach of many entrepreneurs. Starting a cleaning business is simple and does not cost a lot of money. You will need cleaning supplies, a love of cleaning, and determination with a lot of. Thanks to its high and consistent demand, house cleaning is a very lucrative business. On average, a one-person cleaning company can earn upwards of $56, Step-By-Step Guide: How to start a cleaning business? · Identify your market and choose your type of cleaning business · Check your qualifications (Dependent on. Starting a cleaning business doesn't cost a lot of money. If you start a cleaning business the right way, your initial investment could be under $ The process is: · Apply for an ABN (free & you can do it online) · Register a business name (unless you are going to trade under your own name). The cost is. BUSINESS QUICK START GUIDE. FOR JANITORIAL BUSINESSES. Janitorial service is a type of commercial cleaning that tackles different tasks in professional office. Starting a house cleaning business has never been easier! Discover the essential steps you need to take to launch and grow your cleaning business. How To: Start Your Own Cleaning Company · Step One: Do your research · Step Two: Plan your business · Step Three: Register your business · Step Four: Get the. Starting a commercial cleaning business can require some time and investment, but this type of business is typically within reach of many entrepreneurs. Starting a cleaning business is simple and does not cost a lot of money. You will need cleaning supplies, a love of cleaning, and determination with a lot of. Thanks to its high and consistent demand, house cleaning is a very lucrative business. On average, a one-person cleaning company can earn upwards of $56, Step-By-Step Guide: How to start a cleaning business? · Identify your market and choose your type of cleaning business · Check your qualifications (Dependent on. Starting a cleaning business doesn't cost a lot of money. If you start a cleaning business the right way, your initial investment could be under $

How to Start A Cleaning Business in 7 Simple Steps ; Residential cleaning services; Commercial cleaning services; Maid services for daily household cleaning and. Register your commercial cleaning business. Open a small business bank account. Decide which cleaning services to offer. Get commercial cleaning business. How To: Start Your Own Cleaning Company · Step One: Do your research · Step Two: Plan your business · Step Three: Register your business · Step Four: Get the. Business. Page 2. 2. Table of contents. 7. What Type of Cleaning Business Should I Start? What Equipment & Resources Do I Need to Start My Cleaning Business. 8 steps to starting a cleaning business · 1. Identify your target market · 2. Determine your service area · 3. Set your cleaning services and prices · 4. Market. Someone to actually do the cleaning, although you may be a one-man or one-woman show in the beginning · Cleaning supply cart: approximately $ · Business. 5 steps to starting a cleaning business in Florida · 1. Register your business with the state · 2. File a fictitious business statement · 3. Obtain an employer. Starting a house cleaning business requires little startup cash and offers flexibility if done right. Finding clients and getting liability insurance are. Starting a house cleaning business requires little startup cash and offers flexibility if done right. Finding clients and getting liability insurance are. How can I make my cleaning business stand out? You don't necessarily need qualifications to set up a cleaning company, but they can really help attract. Choose a business name that is easy to spell and pronounce, is memorable, and isn't too similar to other cleaners already operating in your area. Pay attention. Licenses and permits: The license and permits you'll need to start your cleaning business will depend on the state, county and city. · Insurance: · Supplies. How to start a cleaning business · Research and plan · Define your services and pricing structure · Obtain necessary licenses and insurance · Setup and Logistics · Step 1 Get your equipment ready. · Step 2 Buy a company vehicle. · Step 3 Hire or subcontract workers as needed. Typically, a residential cleaning business will cost less to start up, but the potential to earn more money is higher with commercial cleaning, which can be. How to Start a Cleaning Business from Scratch · Research the market · Calculate startup costs · Choose your name and brand identity · Sort out the legal side · Buy. More and more people are attracted by the idea of launching their own commercial cleaning business. Perhaps it's because of their lower start-up costs. These include choosing the proper business entity, obtaining any required licenses or permits, dealing with health and safety, advertising, creating policy. 1. Consider whether cleaning is the right business for you · 2. Decide what type of cleaning business to start · 3. Work out the budget for your cleaning business. How to Start a Cleaning Business from Scratch · Research the market · Calculate startup costs · Choose your name and brand identity · Sort out the legal side · Buy.

Betting Site In Uk

SBR reviews the top online sports betting sites. With our detailed guides you can compare the best online gambling sites to get the biggest bonus and. ⚡ Top 20 Betting Sites United Kingdom · Bet - 6,, · Paddy Power - 4,, · William Hill - 4,, · Betfair - 3,, · Unibet (UK) - 3,, Get competitive odds at sport ✓ Online Betting on all major Sports Betting events with Bet Builder, In Play & more. T&Cs Apply! List of All Online Bookmakers in the UK. Only on Bookies Bonuses will you find over betting sites presented all in one place. Check them out below and. Hi all, Which of the UK's sites have the best football offer? I currently bet on paddypower and while their interface is good their football. As previously mentioned, you can find all kinds of football betting bonuses on the UK market, including free bets like the one in our BetVictor review and. For horse racing fans, Betgoodwin is possibly the best new UK betting site available. The online arm of one of the UK's most successful independent bookmakers. Jackbit – Best Betting Site UK Overall. Jackbit Sports UK. Pros: Place 3 bets and get the 4th for free; 10% cashback bet insurance; On-site. Full reviews of the best UK betting sites · 1. talkSPORT BET · 2. PlanetSport Bet · 3. Spreadex · 4. BoyleSports · 5. BetVictor · 6. CopyBet · 7. Luckster Sport. SBR reviews the top online sports betting sites. With our detailed guides you can compare the best online gambling sites to get the biggest bonus and. ⚡ Top 20 Betting Sites United Kingdom · Bet - 6,, · Paddy Power - 4,, · William Hill - 4,, · Betfair - 3,, · Unibet (UK) - 3,, Get competitive odds at sport ✓ Online Betting on all major Sports Betting events with Bet Builder, In Play & more. T&Cs Apply! List of All Online Bookmakers in the UK. Only on Bookies Bonuses will you find over betting sites presented all in one place. Check them out below and. Hi all, Which of the UK's sites have the best football offer? I currently bet on paddypower and while their interface is good their football. As previously mentioned, you can find all kinds of football betting bonuses on the UK market, including free bets like the one in our BetVictor review and. For horse racing fans, Betgoodwin is possibly the best new UK betting site available. The online arm of one of the UK's most successful independent bookmakers. Jackbit – Best Betting Site UK Overall. Jackbit Sports UK. Pros: Place 3 bets and get the 4th for free; 10% cashback bet insurance; On-site. Full reviews of the best UK betting sites · 1. talkSPORT BET · 2. PlanetSport Bet · 3. Spreadex · 4. BoyleSports · 5. BetVictor · 6. CopyBet · 7. Luckster Sport.

In recent years, both Virgin Bet and Parimatch have proven to be two of the best new betting sites to have hit the scene due to some great promotions for both. MansionBet UK has established itself as a reliable online Bookmaker. We're now focusing on helping you find the best online betting sites. We know EXACTLY what. Find the most updated list of new UK betting sites. Compare new gambling sites and find the newest bookmakers with welcome offers and free bets. Looking for the best betting sites in the United Kingdom? We've reviewed and compared top bookies available to UK punters, so you don't have to search for. Our top 10 new betting sites for August · Gentleman Jim. Bet Now · AK Bets. £ · Tote. £50 · PricedUp. Bet Now · Midnite. Bet Now · 7Bet. Bet Now. Experience the excitement of sports betting like never before with Ladbrokes - the perfect choice for new players. We play together! Best Betting Sites UK August ; #1 E-Sports Betting Site. 21Bets Logo. 21Bets. £25 free bet ; Exclusive Offer. Betfoxx Logo. Betfoxx. % up to $ ; New. Top 10 UK Betting Sites – August 10Bet Sports. /5. Rated by UK Gambling Sites ; Bet · Casino - Sport - Poker - Bingo · Visit Site ; William Hill · Casino - Sport - Poker - Bingo · Visit Site ; Betfred · Casino - Sport -. Fitzdares is a fresh name on the UK market with an old school twist: punters can place bets via text and phone – what's more, betting agents on the other line. ✰ A brand new UK sports betting site, with a wide range of markets and features. Easy to use and especially fast on mobile! Betting apps available on. No Offer. Betway continues to flourish in the UK market and remains among the very best bookmakers for weekly promotions, UK-focused markets, and odds competitiveness. betcom ranked number 1 and is the most visited Sports Betting website in United Kingdom in July , followed by vprosto.ru as the runner up, and ladbrokes. Experience the best of online gambling. Join the fun today and sign up for Unibet to receive an incredible welcome bonus! When looking to place bets online at BetUK, then you'll be looking for the betting site with the best betting offers and in our opinion, when looking at UK. Compare odds and offers from 25+ leading UK bookmakers. Build your football accumulators & compare daily racing odds. Get the best expert tips and insight. The Top UK Sports Betting Sites in Our Selection · Ladbrokes · Coral · Betfred · Grosvenor · BoyleSports · Lottoland · Parimatch · Quinnbet. Free Bets And Sign Up Offers ; BetMGM UK · Bet £10, Get £60 in Bonuses · Visit BetMGM UK ; Skybet · £30 in Free Bets when you place any bet · Visit Skybet ; bet Sky Bet is one of the few betting sites that come close to the high standards set by bet They performed well at the Bookmaker Awards, despite not winning in. Licensing- A UK license from the UK Gambling Commission is a sign you can trust the new UK bookmaker. Variety of banking methods - There should be a variety of.

Difference Between Regular And Executive Mba

The primary difference between an MBA and an EMBA is that an MBA caters to early to mid-career professionals as well as those looking to switch industries. An. The Helzberg School of Management at Rockhurst University is known internationally for its superior development of values-driven business leaders. The main distinctions are program structure, delivery model, and format. The EMBA accommodates working students further along in their careers. Other. Thus, the major difference between the MBA and Executive MBA is that students can work and study together. Executive MBA courses are often school evenings or. While a conventional MBA may prepare someone to enter a management career, an Executive MBA is intended to teach a current leader how to be a more effective. An executive MBA cohort will cater to older professionals who have more work experience, while the candidates of part-time programs typically have similar. The key differences between an Executive MBA Program and a Full-Time MBA Program involve timing, location, and career profiles. Executive MBA students are. Want to know the difference between MBA and executive MBA? We at Yocket have prepared a complete guide with detailed diff between MBA and executive MBA. An MBA, short for Master of Business Administration, is a general management degree. There are one and two-year programs, but both tend to be full-time and. The primary difference between an MBA and an EMBA is that an MBA caters to early to mid-career professionals as well as those looking to switch industries. An. The Helzberg School of Management at Rockhurst University is known internationally for its superior development of values-driven business leaders. The main distinctions are program structure, delivery model, and format. The EMBA accommodates working students further along in their careers. Other. Thus, the major difference between the MBA and Executive MBA is that students can work and study together. Executive MBA courses are often school evenings or. While a conventional MBA may prepare someone to enter a management career, an Executive MBA is intended to teach a current leader how to be a more effective. An executive MBA cohort will cater to older professionals who have more work experience, while the candidates of part-time programs typically have similar. The key differences between an Executive MBA Program and a Full-Time MBA Program involve timing, location, and career profiles. Executive MBA students are. Want to know the difference between MBA and executive MBA? We at Yocket have prepared a complete guide with detailed diff between MBA and executive MBA. An MBA, short for Master of Business Administration, is a general management degree. There are one and two-year programs, but both tend to be full-time and.

1. Executive MBA Programs Usually Require More Experience. Some traditional MBA programs require work experience, but an EMBA usually requires five or more. EMBAs and MBAs (full-time or part-time) are fundamentally different. Below are a few points to illustrate their differences that can help you determine which. Executive MBA programs are designed for individuals who are already well-versed in the business world, whereas MBA programs are more flexible, accommodating. An executive MBA program referred to as an EMBA enables executives to earn the degree while continuing to hold their existing jobs. An Executive MBA is designed for experienced professionals with significant work experience and is typically completed while working part-time. In contrast, a. Most schools use case studies for practice, but these do not involve real-world application from the students' workplaces. One notable exception is the. This blog will delve into these three different formats, focusing on the comparison of the Online MBA vs Executive MBA, to help you make an informed decision. The content and curriculum of an Executive MBA is quite similar to an MBA, however, typically there will be more emphasis on individual leadership development. An executive MBA is very different from a regular MBA in terms of campus life, interactions, social life, student demographics, Executive MBA fees and much. An EMBA program enriches students with a more in-depth knowledge of business management, process, markets, and tools. This, coupled with lesser effort and time. Course structure: An executive MBA usually covers the same classes as a traditional, albeit at a faster rate. Also, EMBA programmes offer fewer electives as. EMBAs are superior to MBAs. They're essentially the same degree, but EMBAs are structured for current (rather than aspiring) executives and tend to be more. An overview of the differences between Executive MBA programs, which are designed for students with five-to-ten years of professional business experience. The difference between an EMBA and an MBA is that the coursework is less about general knowledge and more focused on refining skills through specific. A part-time master's program could take a working professional several years to complete, depending on how many classes are taken per semester. Most executive. The key difference between an Executive MBA (EMBA) and a regular MBA lies in their target audience, format, and experience level required. Differences between Executive MBA vs Full-Time MBA A Full-Time MBA differs from an Executive MBA in essentially these aspects – Target student profile and. Executive MBA vs MBA. An EMBA is similar to a Master of Business Administration Program in terms of qualifications and requirements. What sets these two. A part-time master's program could take a working professional several years to complete, depending on how many classes are taken per semester. Most executive. An MBA is an advanced business degree program that prepares students to become business leaders in many areas, such as finance, marketing, human resources, and.

How To Dispute Debt Collection On Credit Report

Remember that paying off an old debt may not erase it from your credit history. Also, if you settle the debt, some collectors will report that on your credit. Should I dispute a collection on my credit report? Believe it or not, the option to dispute debt is a protected right. Under the Fair Credit Reporting Act . If you doubt that you owe a debt, or that the amount owed is not accurate, your best recourse is to send a debt dispute letter to the collection agency. Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. Once you dispute a debt, the debt collector has to cease all collection activity and cannot report it to the credit reporting agencies (CRA). If he has. If you wish to dispute the debt or request verification of the debt, send a letter requesting verification of the debt to the debt collector within 30 days of. If you disputed with a debt collector, the debt collector must tell the credit agencies to mark it as disputed. If the debt is not marked as. Place a negative remark / note on your credit report if you file a dispute. The Collection Law requires the agency to validate the debt first by obtaining a. Make sure you respond in writing to dispute the debt. If you don't, the debt collector may keep trying to collect the debt from you and may even end up suing. Remember that paying off an old debt may not erase it from your credit history. Also, if you settle the debt, some collectors will report that on your credit. Should I dispute a collection on my credit report? Believe it or not, the option to dispute debt is a protected right. Under the Fair Credit Reporting Act . If you doubt that you owe a debt, or that the amount owed is not accurate, your best recourse is to send a debt dispute letter to the collection agency. Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. Once you dispute a debt, the debt collector has to cease all collection activity and cannot report it to the credit reporting agencies (CRA). If he has. If you wish to dispute the debt or request verification of the debt, send a letter requesting verification of the debt to the debt collector within 30 days of. If you disputed with a debt collector, the debt collector must tell the credit agencies to mark it as disputed. If the debt is not marked as. Place a negative remark / note on your credit report if you file a dispute. The Collection Law requires the agency to validate the debt first by obtaining a. Make sure you respond in writing to dispute the debt. If you don't, the debt collector may keep trying to collect the debt from you and may even end up suing.

Credit, Debt and Bankruptcy. Types of Debt & Credit Issues. Most common Both TransUnion and Equifax have dispute resolution services that are free of. To dispute a debt, you need to contact the creditor in writing. Consumer Protection BC provides a form you can use. · Meanwhile, if you think the debt collector. to dispute wrong information on your credit report. Follow this checklist: □ Write to the credit reporting agency. Include your name, address, date of. When debt collectors first contact you, they should tell you the amount that you owe, the name of the creditor, and that you have 30 days to dispute the debt in. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that. We recommend downloading and completing our Auto Loan Credit Bureau Dispute Form and providing all the relevant information that explains your situation. Return. 11 Reasons to Dispute a Collection on Your Credit Report · The debt is obsolete · Lack of notification · ❌ Inaccurate information · Identity theft or fraud. If You Dispute a Debt If you dispute the legitimacy of something in your debt collector's file, you must give the collector written notice. Simply calling the. Reporting information that you know to be inaccurate or failing to report information correctly violates the Fair Credit Reporting Act § s Should you. Additionally, the debt won't show up on your credit report during the dispute process. However, if they determine you do owe the debt, collection efforts will. You may be able to ask the collection agency, the original creditor or both to request the credit bureaus delete the delinquency from your credit reports as a. In some cases, the debt may be too old to affect your credit report or credit scores. If you don't believe you owe the debt, you can dispute it with the debt. reported it, please contact the credit reporting agencies, inform them that the debt is disputed, and ask them to delete it from my credit report. Reporting. So, if you check your credit report and discover a collection account that shouldn't be there, you can send a dispute to Equifax, TransUnion, or Experian and. period is the time within which the collection agency may take legal action to collect the debt. credit reports, you can dispute the debt by sending in a. What documents will I need to provide for my dispute? · Bankruptcy schedules or other court documents · Student loan disability letters · Cancelled checks. If you agreed to pay "collection costs," the debt collector can add reasonable charges such as attorney fees, court costs or credit reports. If the agency is. How to Dispute a Debt Within five days after a debt collector contacts you for the first time, they must send a written notice detailing the amount you owe. the debt as required by the Fair Debt Collection reporting agencies, inform them that the debt is disputed, and ask them to delete it from my credit report. You can write to the credit bureaus to ask them to fix any inaccurate information on your credit report. You can find instructions for how to dispute incorrect.

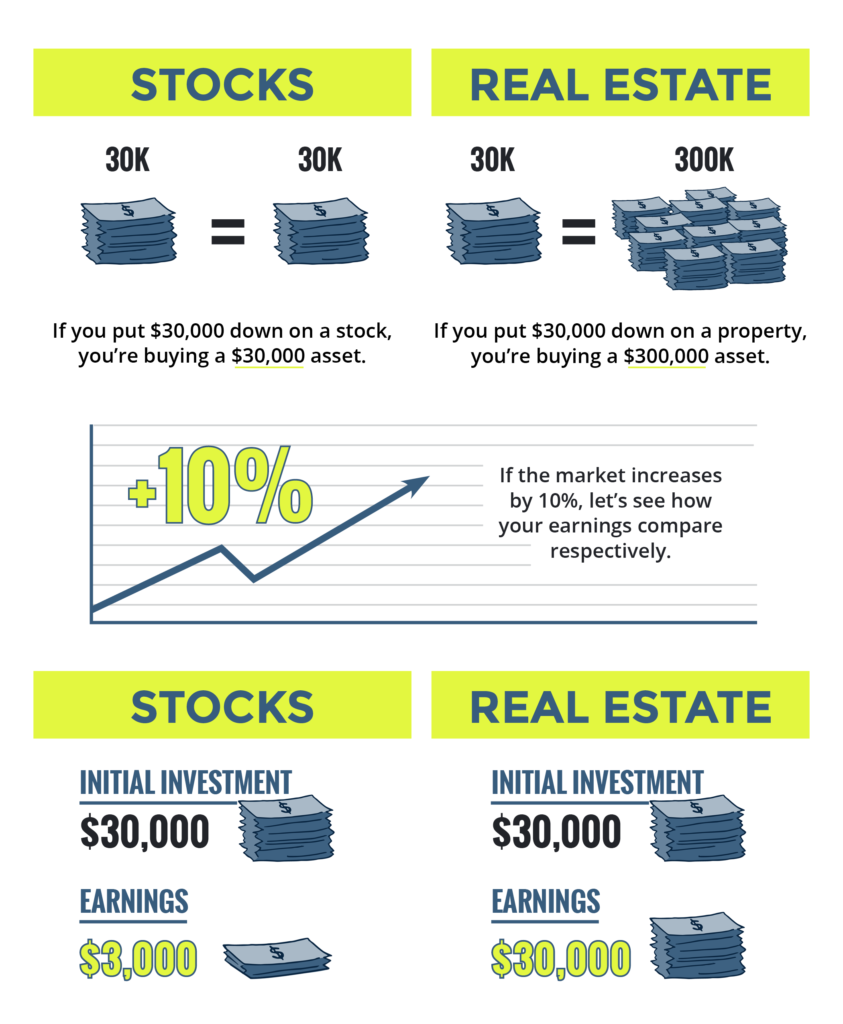

Investing In House Vs Stocks

In conclusion. It's worth noting you don't actually have to choose between stocks and property. You can actually invest in property on the stock market with. Property is less volatile as an investment than the stock exchange. For many people, property is easier to understand than stocks and shares, and historically. In real estate investment, you absolutely can, as an individual, consistently outperform the stock market. That said, most people should just. Real estate is harder to buy and sell because it's a physical asset: it's harder to sell your house than a stock. Ownership shares in a private REIT or PE fund. For stocks, it's straightforward because you can buy, hold, and not have any recurring expenses. However, with a property investments, you must consider your. The Northern California Real estate vs. the stock market. A tale of two heavyweights. But which will come out on top as a better investment? Stocks are relatively riskier investment assets. They are more volatile in comparison real estate. Real estate assets on the other hand are less. I have found that real estate provides many advantages over the stock market. You can make returns of more than 10% on the cash you invest from rental income. Real estate has higher risk-adjusted returns than the stock market. Although housing prices do not grow as quickly as equities, there is a comparatively lower. In conclusion. It's worth noting you don't actually have to choose between stocks and property. You can actually invest in property on the stock market with. Property is less volatile as an investment than the stock exchange. For many people, property is easier to understand than stocks and shares, and historically. In real estate investment, you absolutely can, as an individual, consistently outperform the stock market. That said, most people should just. Real estate is harder to buy and sell because it's a physical asset: it's harder to sell your house than a stock. Ownership shares in a private REIT or PE fund. For stocks, it's straightforward because you can buy, hold, and not have any recurring expenses. However, with a property investments, you must consider your. The Northern California Real estate vs. the stock market. A tale of two heavyweights. But which will come out on top as a better investment? Stocks are relatively riskier investment assets. They are more volatile in comparison real estate. Real estate assets on the other hand are less. I have found that real estate provides many advantages over the stock market. You can make returns of more than 10% on the cash you invest from rental income. Real estate has higher risk-adjusted returns than the stock market. Although housing prices do not grow as quickly as equities, there is a comparatively lower.

Investors can see and feel a house. They often look at shares in companies as intangibles that have little to no inherent value- something akin to a Bitcoin. Key Takeaways · Stocks typically provide higher returns, while real estate appreciates over time and offers rental income and tax benefits. · Real estate. No, real estate investors can't predict housing market movements, just like stock investors can't predict stock market movements. But they don't have to. In the. Effortlessly invest in a rental home or vacation rental and start earning passive income. · Browse Properties · Select Property · Buy Shares · Earn Rental Income &. Historically, both real estate and stocks have been great investments, outperforming inflating by 2% (real estate) and 8% (stocks) a year on average. Hence, the. Real Estate Has Higher Transaction Costs Than The Stock Market · Real Estate is the Only thing that is “Real” · Leverage Increases Real Estate Returns · Real. Real estate investment offers preferred tax positions, higher return on equity, the ability to use leverage to scale up investments, and passive income. This guide provides an overview of shares (stocks) vs. property investing to help determine which path is right for your financial goals and risk tolerance. The stock market, on average, beats real estate by the proverbial mile. However, that ignores the leverage you get by using mortgages. Accounting for a 5×. Buying land for timber, farmland, or hunting land is a sound investment. We feel like the real estate market is a better investment than playing stock markets. The main difference is one is more passive. The stocks won't require maintenance and capital improvements, nor have tenant problems. So make. Sometimes we think that the stock market has wild swings in value because we see it each day on the TV, but let's also not forget declines in. Property Taxes. Stocks: There are no property taxes directly associated with stock investments. Real Estate: Property owners are typically subject to annual. Real estate investment offers preferred tax positions, higher return on equity, the ability to use leverage to scale up investments, and passive income. A commonly held view is that investing in property is less risky than investing in shares. This is hard to really quantify, as shares are traded daily with. Real estate can be owned for free while stocks never can. You can buy a property for k with 40k down, the value goes up to k and you want to cash out. We will be comparing the pros and cons of stocks or real estate investment properties. We will also analyze historical data and show you how to calculate. Real estate is harder to buy and sell because it's a physical asset: it's harder to sell your house than a stock. Ownership shares in a private REIT or PE fund. Both stocks and real estate offer unique benefits and risks – many investors would argue that real estate is a superior investment strategy. The longer you stay invested, the more returns accrue over time as long-term stock investments fetch substantial returns. When you invest in real estate, you.

1 2 3 4 5 6